Published: June 04, 2025 at 4:11 am

Updated on August 15, 2025 at 2:33 pm

What if the clouds hanging over the cryptocurrency landscape finally cleared? Enter Paul Atkins, the newly appointed SEC Chair, ready to redefine the rules of the game. In a seismic shift, Atkins embodies a promise of rejuvenation for crypto regulations—one poised to spark significant growth in the digital asset arena and captivate institutional investors. This chapter offers a tantalizing glimpse for all engaged in the crypto cosmos.

Atkins’ arrival is like a breath of fresh air for weary investors navigating the convoluted terrain of cryptocurrency regulations. An advocate for intelligent and pragmatic policies, he brings a beacon of hope to a market historically shrouded in complexity. This isn’t just about simplifying regulations; it’s about fostering a legal framework that simultaneously promotes innovation and protects investors. Stakeholders across crypto are on the brink of a transformative era, one where clarity reigns and opportunities flourish.

Consider the potential: a revamped regulatory environment could ignite a wave of institutional investment unlike any we’ve seen. For far too long, inconsistent enforcement and grey areas in regulation kept big players at bay. But now, under Atkins’ guidance, the SEC is crafting regulations that could pave the way for institutional influx, inviting traditional financial firms to engage with crypto assets openly. This refreshing clarity is set to alter the dynamics, steering the sector toward a robust state ripe for expansion and sustainability.

Innovation in cryptocurrency has often struggled against the weight of regulatory uncertainty. However, Atkins aims to strike a delicate balance; the SEC is positioned to nurture technological advancements while ensuring the market’s integrity is uncompromised. This vision transcends mere compliance, aspiring to weave digital currency innovation into the financial fabric, benefiting both creators and investors. Such a commitment not only encourages entrepreneurial spirit but lays the groundwork for a new standard in international regulation.

Imagine a world where the capricious swings of the crypto market are tempered by clear regulations. Such a transformation could minimize the speculative fervor that often drives volatility. By establishing straightforward guidelines and regulations, we are looking at a future where cryptocurrency trading becomes more stable and appealing to a wider investor base—including those historically cautious institutions. This pivotal change could prove invaluable, enhancing the perception of digital assets as secure investments.

The implications of the SEC’s regulatory shifts will resonate far beyond U.S. borders. As one of the most influential economic forces, America’s establishment of reasonable and clear crypto regulations could inspire a collective movement amongst other nations. Such global alignment is essential for fostering a thriving crypto market where innovation flourishes unimpeded, while investor protection remains paramount. The SEC’s progressive approach could indeed galvanize other regulatory bodies worldwide to adopt similar philosophies, thus bolstering global marketplace stability and growth.

In this thrilling era under Paul Atkins, the trajectory of crypto regulation appears promising. With a focus on judicious policies, an opening for institutional engagement, and a commitment to innovation, the SEC is steering toward monumental evolution. This new regulatory landscape invites all stakeholders to dive headfirst into the digital asset revolution, enveloped in an atmosphere that prioritizes clarity, growth, and investor security. Indeed, the forthcoming age for the cryptocurrency sector is not just promising—it’s electrifying, ushering in a harmonious blend of regulation and innovation that will shape the future for years to come.

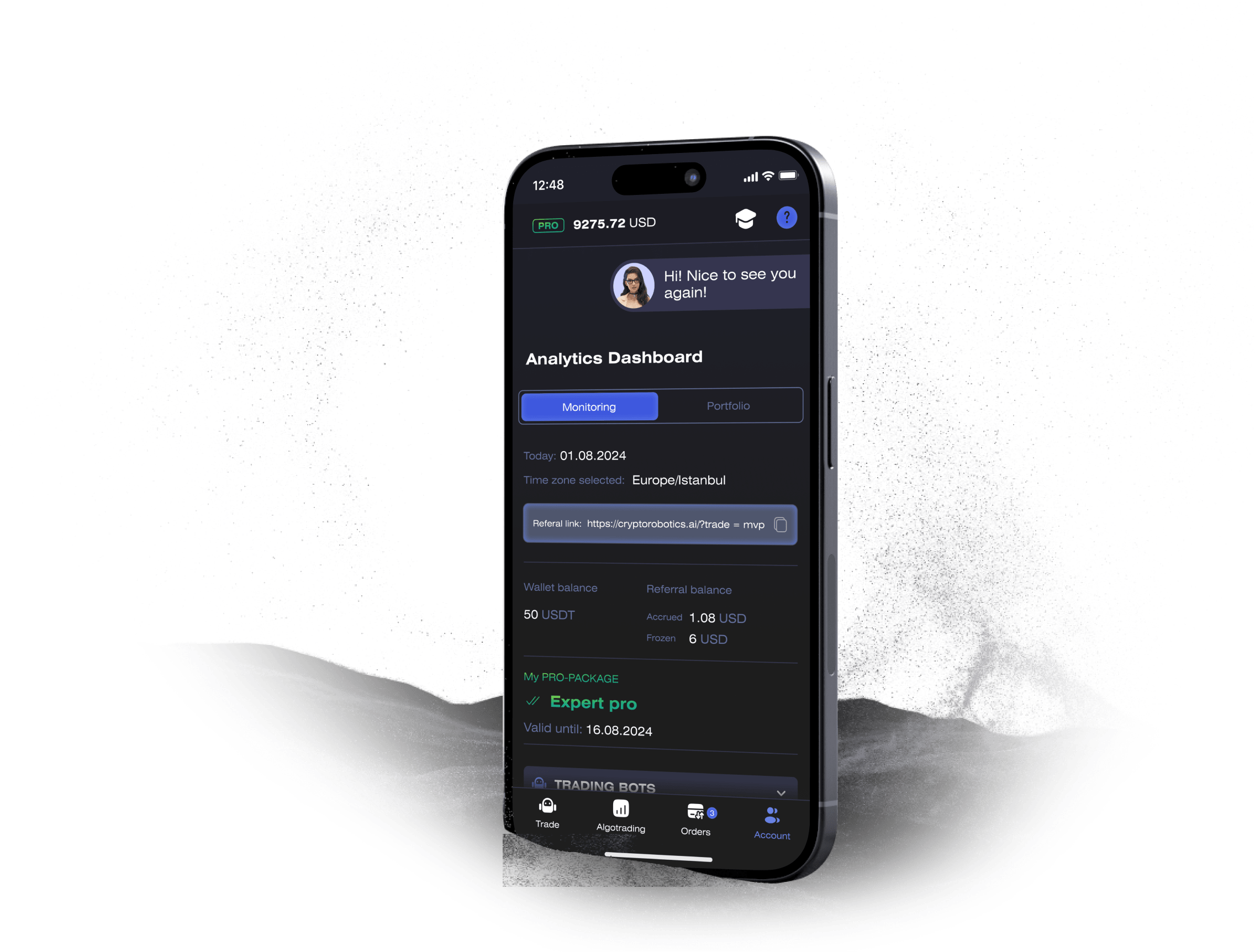

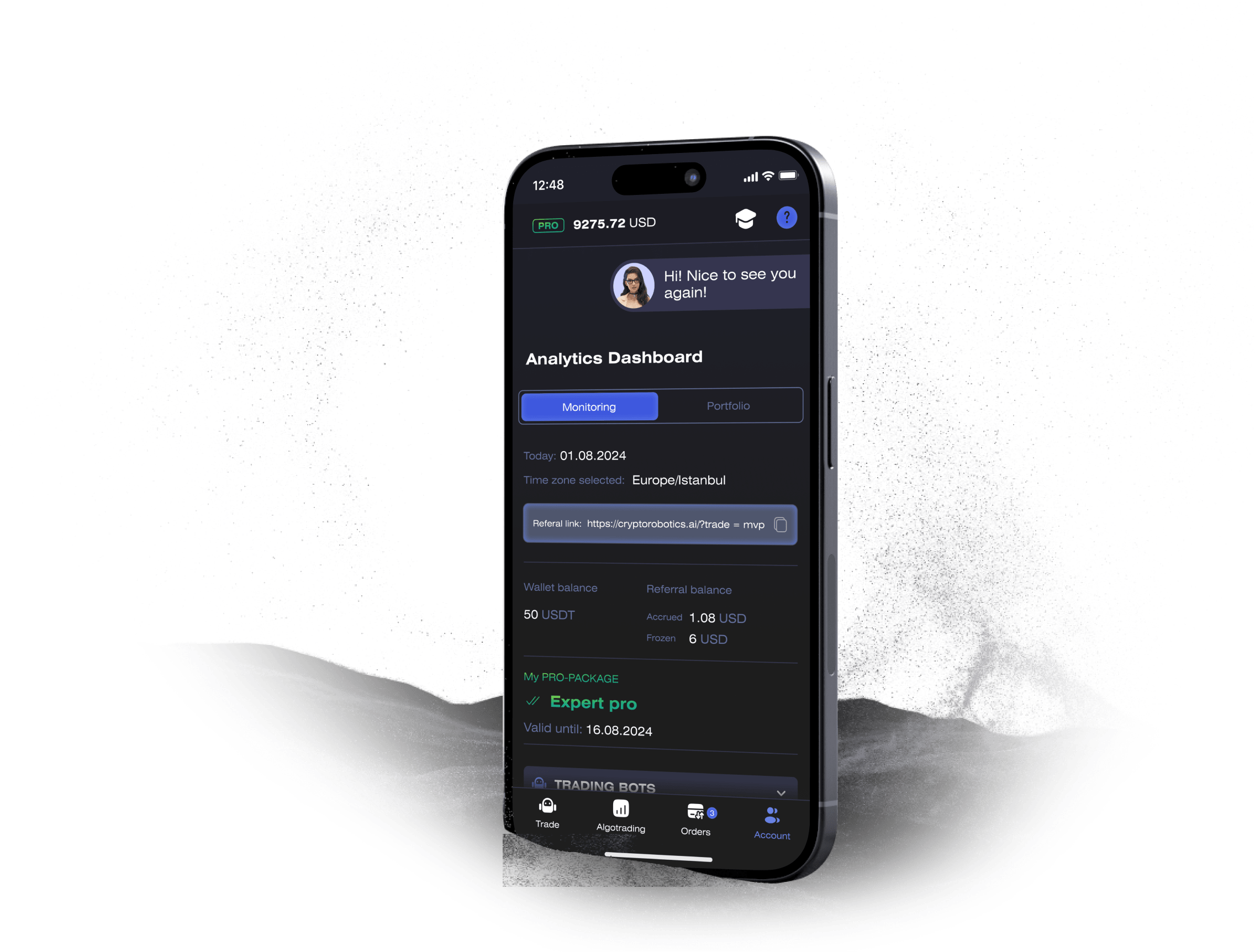

Access the full functionality of CryptoRobotics by downloading the trading app. This app allows you to manage and adjust your best directly from your smartphone or tablet.

News

See more

Blog

See more