Published: January 14, 2026 at 2:33 pm

Updated on January 14, 2026 at 2:33 pm

In a landscape where cryptocurrency often finds itself shrouded in uncertainty, a legislative breakthrough is on the horizon—the CLARITY Act. This initiative seeks to cut through the murky waters that have historically ensnared digital assets, with Ethereum standing at the forefront of this movement. As the Ethereum network pulsates with activity, the anticipation surrounding this legislative effort raises a pivotal question: How will this reshape the cryptocurrency ecosystem for investors and a myriad of participants involved?

The current climate of ambiguity in the cryptocurrency arena acts as a roadblock for institutional investments. The CLARITY Act aims to shine a spotlight on this haze, establishing a clear regulatory framework for digital assets such as Ethereum. Importantly, this act doesn’t merely promise clarity; it sets the stage for potential exemptions in Ethereum staking, which could release a torrent of institutional funding, alleviating compliance concerns and enhancing investor confidence. By delineating a legally sound environment, the act could propel Ethereum into the mainstream spotlight, underscoring its transformative potential in the world of institutional finance.

In a striking display of engagement, the Ethereum network is witnessing record levels of user activity—a clear indication of the surge in interest that the CLARITY Act has sparked. The prospect of this legislation has galvanized not just seasoned investors but also newcomers to the crypto realm, all eager to witness the unfolding drama. By proposing changes that could streamline and fortify Ethereum transactions, the act further amplifies attention on an already thriving network, suggesting a robust future for the platform.

The implications of the CLARITY Act extend far beyond Ethereum itself, poised to reshape the landscape for crypto exchanges and investors alike. This act represents a crucial pivot towards a more structured, innovative, and accessible marketplace. By addressing long-standing fears surrounding regulatory compliance, the act promises to boost confidence among stakeholders and may ignite a wave of creative market developments. It lays a robust foundation for various digital commodities, enhancing opportunities for growth throughout the cryptocurrency ecosystem.

At the heart of the CLARITY Act’s promising future is a bipartisan consensus that is essential for navigating the twists and turns of the legislative process. The anticipated staking exemptions for Ethereum may act as a catalyst, sparking increased trading activity and attracting a new audience eager to engage with Ethereum’s diverse utility. This collaborative effort underscores the need for thoughtful regulation that captures the complexity of the ever-evolving digital market.

As the CLARITY Act inches toward becoming a reality, its potential to reshape Ethereum and the broader domain of digital assets is profound. This legislation has the power to recalibrate market dynamics, amplify institutional interest, and cultivate a safer, more vibrant crypto environment. Stepping into a new era of regulatory clarity, the crypto community stands ready to embrace the myriad opportunities and challenges that this pivotal framework is set to unveil. With the CLARITY Act, the future of Ethereum and its ecosystem gleams with possibility, urging stakeholders to prepare for a transformative journey ahead.

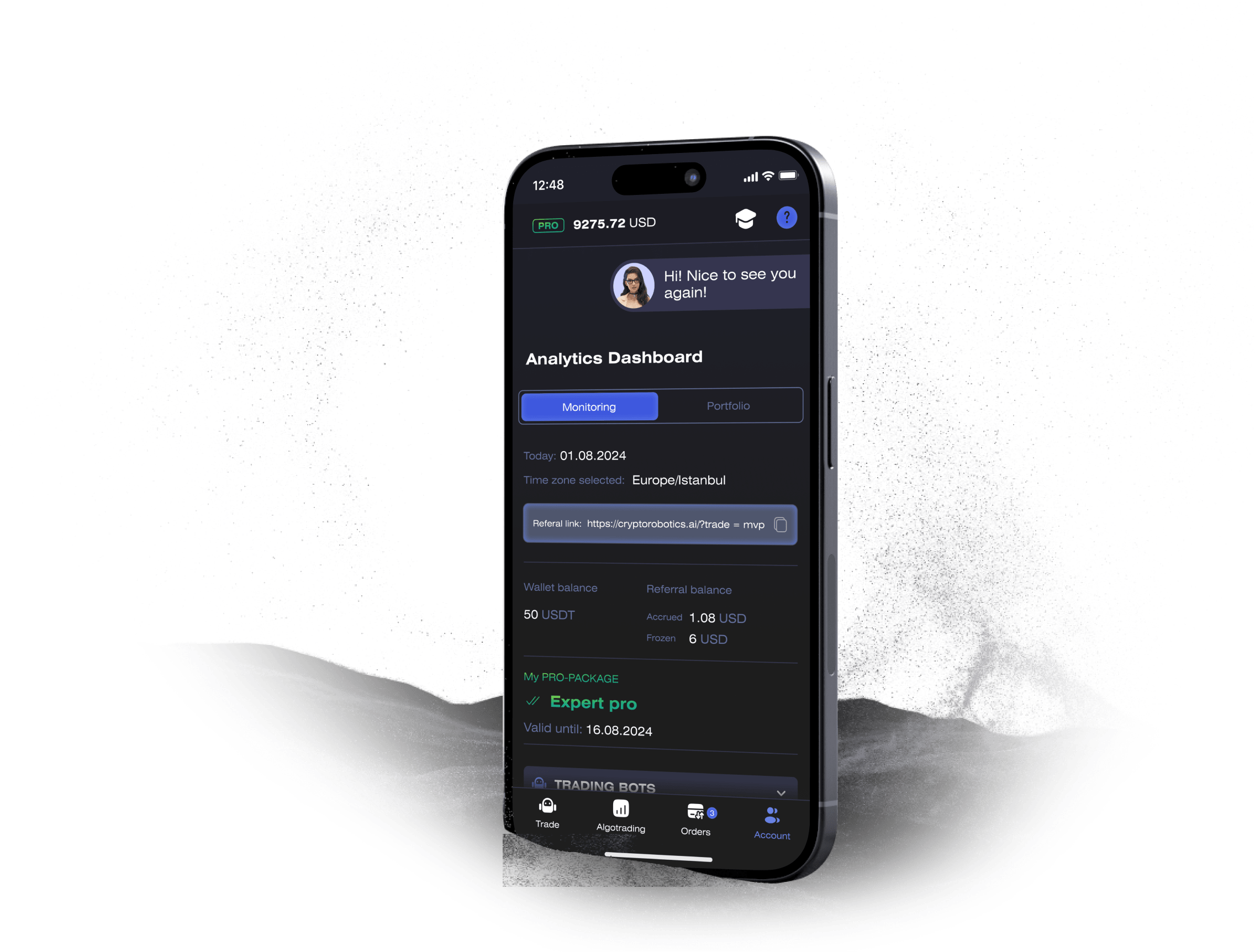

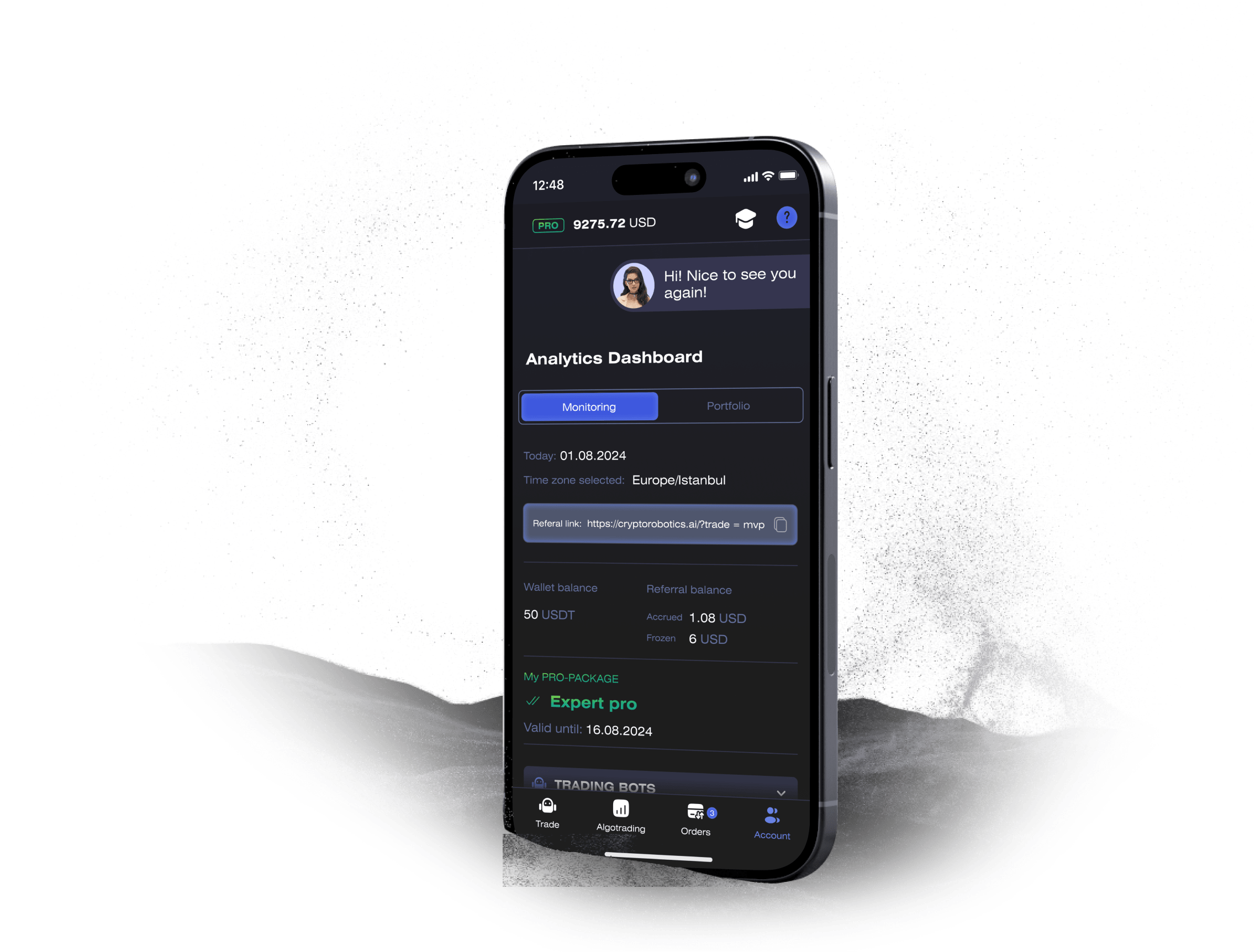

Access the full functionality of CryptoRobotics by downloading the trading app. This app allows you to manage and adjust your best directly from your smartphone or tablet.

News

See more

Blog

See more