Published: January 08, 2026 at 7:13 pm

Updated on January 08, 2026 at 7:13 pm

What if I told you that one man’s ambition to revolutionize finance would lead not to glory, but to a cautionary tale of betrayal, greed, and colossal faux pas? Welcome to the saga of Chen Zhi — a twisted narrative that unfurls a tapestry woven with intrigue, fraud, and the perilous underbelly of the cryptocurrency universe. Chen’s rise and fall is not merely a high-profile scandal; it’s a jarring wake-up call for an industry in desperate need of introspection and fortification against the harsh realities of financial crime.

At the center of this drama lies Chen Zhi, a man who once basked in the glow of reverence within the crypto community. Today, however, he finds himself depicted as the architect of a sprawling cross-border fraud operation. The grim trajectory of his downfall began with his extradition, which cast a long, ominous shadow over what was once a burgeoning crypto empire. This shift from celebrated entrepreneur to cautionary archetype serves as a stark reminder of how quickly ambition can transform into something sinister, exposing the vulnerabilities lurking within the cryptocurrency landscape.

The staggering seizure of $14 billion in Bitcoin has sent shockwaves throughout the digital currency markets, igniting fervent debates about the fragility of Bitcoin’s liquidity and the unsettling ease with which its market can be manipulated. This monumental event has unearthed a sobering truth — that in the chaotic realm of crypto, wealth can easily morph into a tool for deception. It begs the urgent inquiry: to what extent are cryptocurrency markets ensnared by the dark forces of financial misconduct?

With the dust beginning to settle following the Chen Zhi debacle, the focus now shifts to the international coalition against crypto-related crimes. The fallout from this narrative transcends the misdeeds of one individual; it heralds a critical juncture for global regulatory efforts to regain control over the murky waters of digital finance. This situation illustrates law enforcement’s unyielding commitment to purging the ecosystem of illicit activities, suggesting that Chen Zhi’s misadventures could be a catalyst for reform in the realm of cryptocurrency regulation.

The unraveling of Chen Zhi serves as a grim reminder of the pervasive risks that besiege the cryptocurrency sector. The elaborate schemes he supposedly orchestrated highlight a critical imperative for stakeholders: amplifying their defenses against financial fraud. This grim episode isn’t merely a tale of misconduct; it acts as a rallying cry for the crypto community to strive for greater transparency and ethical trading practices, thus fortifying the market against future threats that loom just beneath the surface.

For countless traders and the new wave of AI-enhanced trading technologies, the search for pristine Bitcoin liquidity has become increasingly vital. In this precarious environment, ethical trading practices and robust security protocols emerge as essential pillars. Only through a firm commitment to integrity and compliance can the cryptocurrency sector hope to rehabilitate its sullied image and provide a secure trading atmosphere for all its participants. As part of this effort, traders often turn to elite crypto signals and crypto quality signals to navigate this landscape effectively.

Chen Zhi’s turbulent narrative stands as a clarion call for regulatory frameworks that evolve swiftly to keep pace with the rapid changes in cryptocurrency. As digital finance forges ahead, the need for resilient and adaptive policies becomes more pressing than ever. These initiatives, paired with ongoing efforts to educate all stakeholders and reviews of crypto trading bots, are essential for maintaining market integrity and safeguarding investor interests in this dynamic landscape of digital assets.

The Chen Zhi crypto scandal has illuminated the complex interplay among innovation, regulation, and illegality in our increasingly digital age. It emphasizes the critical necessity for stronger international cooperation and more robust regulatory structures to navigate the complexities embedded within the crypto market. The road ahead is unmistakable: we must cultivate a transparent, secure, and resilient digital finance ecosystem that can engender and preserve investor confidence globally. As we stand at this moment of reckoning, the choice between embracing meaningful change or succumbing to the shadows of deceit will define the very future of cryptocurrency.

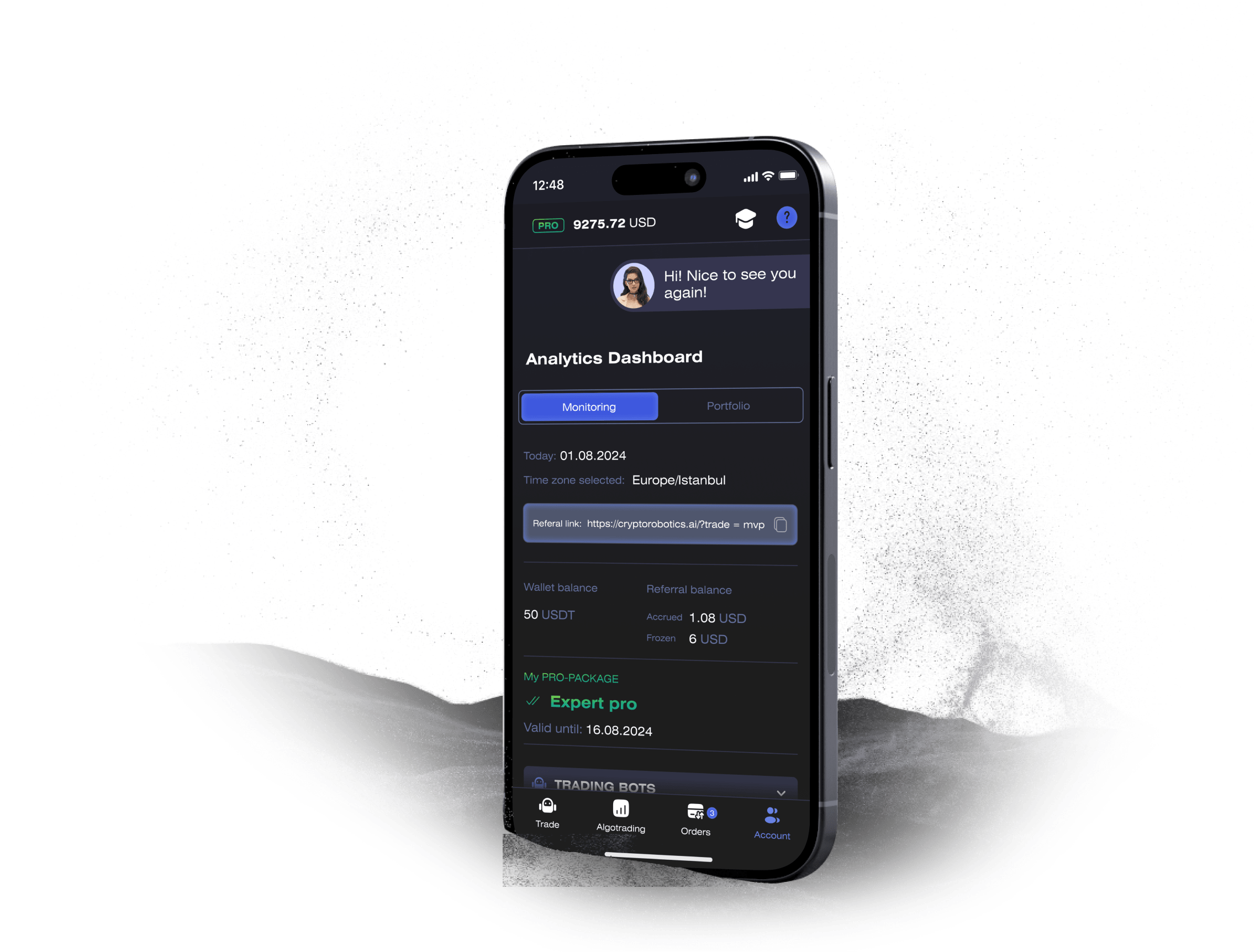

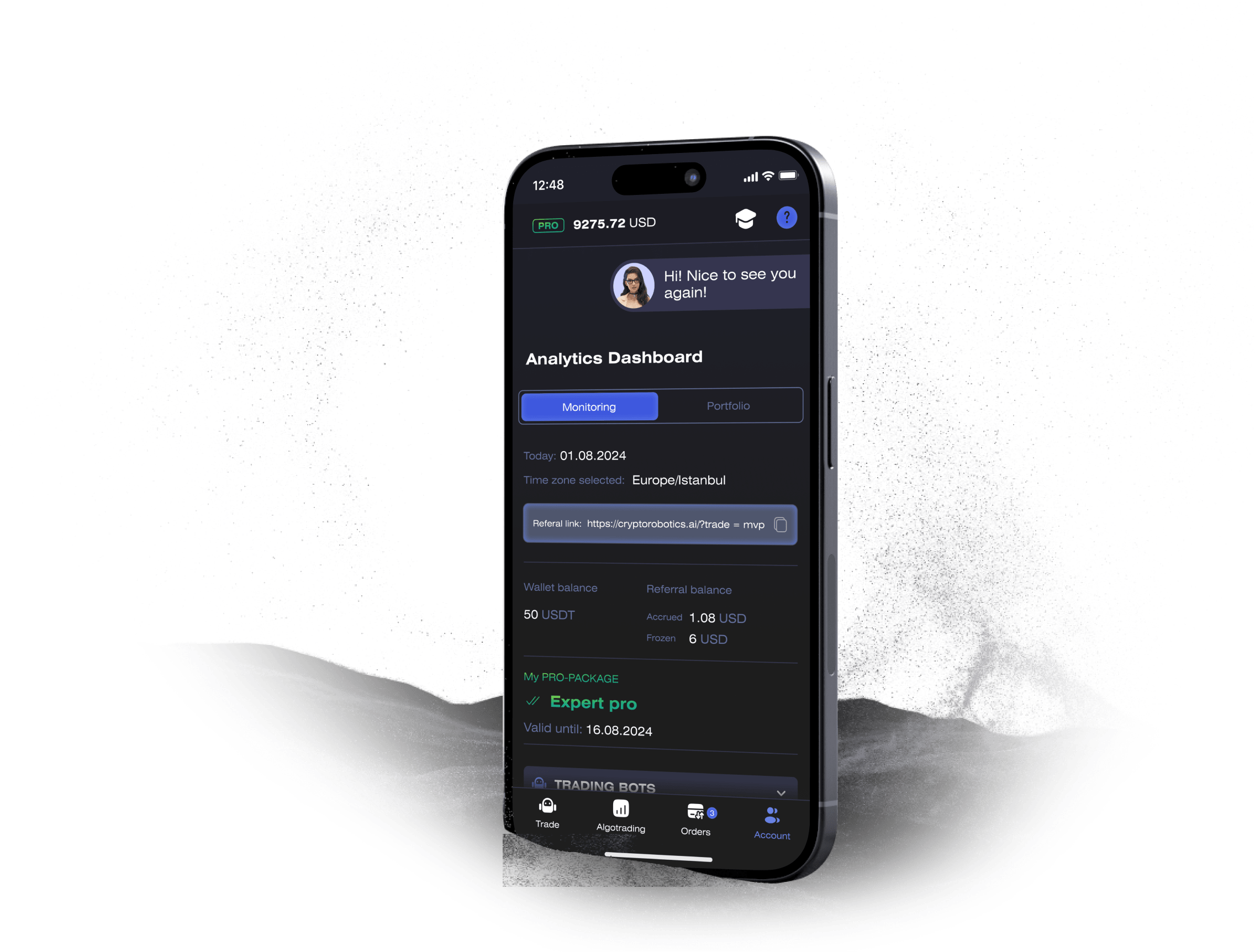

Access the full functionality of CryptoRobotics by downloading the trading app. This app allows you to manage and adjust your best directly from your smartphone or tablet.

News

See more

Blog

See more