Published: January 26, 2026 at 1:31 pm

Updated on January 26, 2026 at 1:31 pm

What would it mean for your financial transactions to become instant? The financial industry is teetering on the edge of a colossal revolution that promises to redefine how we trade and settle securities. The concept of T+0 settlement, coupled with the rise of tokenized securities, heralds exciting possibilities but also unveils a landscape fraught with challenges. As we embark on this thrilling yet precarious journey, it is essential to recognize the intricate balance between immediacy and vigilance in the realm of finance.

At the core of this seismic shift is the ambitious push towards same-day settlement, or T+0, aimed at obliterating the delays between the initiation and completion of financial transactions. The appeal is undeniable: a faster, more liquid financial marketplace that enhances operational efficiency. However, a recent outlook from Deloitte issues an urgent warning about this seemingly bright future. Rapid-fire trading could easily outpace the regulatory frameworks currently in place to uphold market integrity, leading to a chaotic environment where the rules struggle to keep up with the pace of innovation.

Simultaneously, we witness the emergence of tokenized securities—traditional assets transfigured into digital tokens leveraging blockchain technology. This evolution promises enhanced efficiency and streamlined operations but is not without its risks. The prospect of reduced intermediaries and quicker asset transfers raises alarms about potential declines in financial transparency and the lurking threat of market manipulation, particularly if robust auditing standards and reporting protocols are not established concurrently.

Embracing T+0 settlement accelerates transaction timelines, leaving little room for error correction and hence amplifying operational risks inherent in trading. Deloitte stresses that financial institutions must adapt swiftly, integrating enhanced reporting mechanisms that ensure transparency isn’t sacrificed on the altar of speed.

Moreover, the frenetic pace invites scrutiny of liquidity concentration and the challenging dynamics of trade order routing. With the financial landscape racing towards this new frontier, the paramount importance of cybersecurity cannot be overstated. The trust upon which markets depend must be fortified, protecting investors from potential fallout in an increasingly risky environment.

As the landscape transforms, so too does the regulatory framework guiding these changes. Initiatives announced at the STAC Conference by Jamie Selway, Director of the SEC’s Division of Trading and Markets, signal a vigilant yet progressive approach. The exploratory measures taken by the SEC and the Commodity Futures Trading Commission—including no-action letters and pilot programs—indicate a cautious stride into this novel territory, balancing the need for innovation with the responsibility of effective oversight.

In this new era, stablecoins and advanced blockchain systems stand to become foundational components, promising pathways to instantaneous settlements and unprecedented operational efficiencies. Yet, as these technologies gain momentum, the challenge remains to cultivate an environment where innovation does not overshadow the fundamental principles of fairness and stability that underpin the market.

Looking ahead, it is clear that the convergence of T+0 settlement with tokenized assets will fundamentally alter the operational dynamics of the financial sector. Yet, this transition also brings forth significant hurdles—assuring market stability, maintaining transparency, and adeptly navigating the intricate web of regulatory frameworks will be vital.

The New York Stock Exchange’s efforts to establish a 24/7 tokenized trading and on-chain settlement platform encapsulate this informative shift. A remarkable fusion of traditional and futuristic practices, this endeavor aims to redefine liquidity and settlement standards. As traditional finance collides with blockchain, we stand at the cusp of a future where real-time settlements may become standard fare.

The transition to T+0 settlement and tokenized securities embodies the finance sector’s relentless quest for greater efficiency and accessibility. Yet, these advancements kindle urgent discussions regarding the equilibrium between innovation and risk, regulatory evolution, and the ever-critical need to uphold market integrity. As the industry navigates these brave new waters, collaboration among regulators, institutions, and innovators will be crucial. Together, they must steer this ship with precision, keeping an eye on both immediate possibilities and foundational principles, ensuring that this transformative era of financial technology achieves its immense potential while safeguarding the core tenets of equitable market operation.

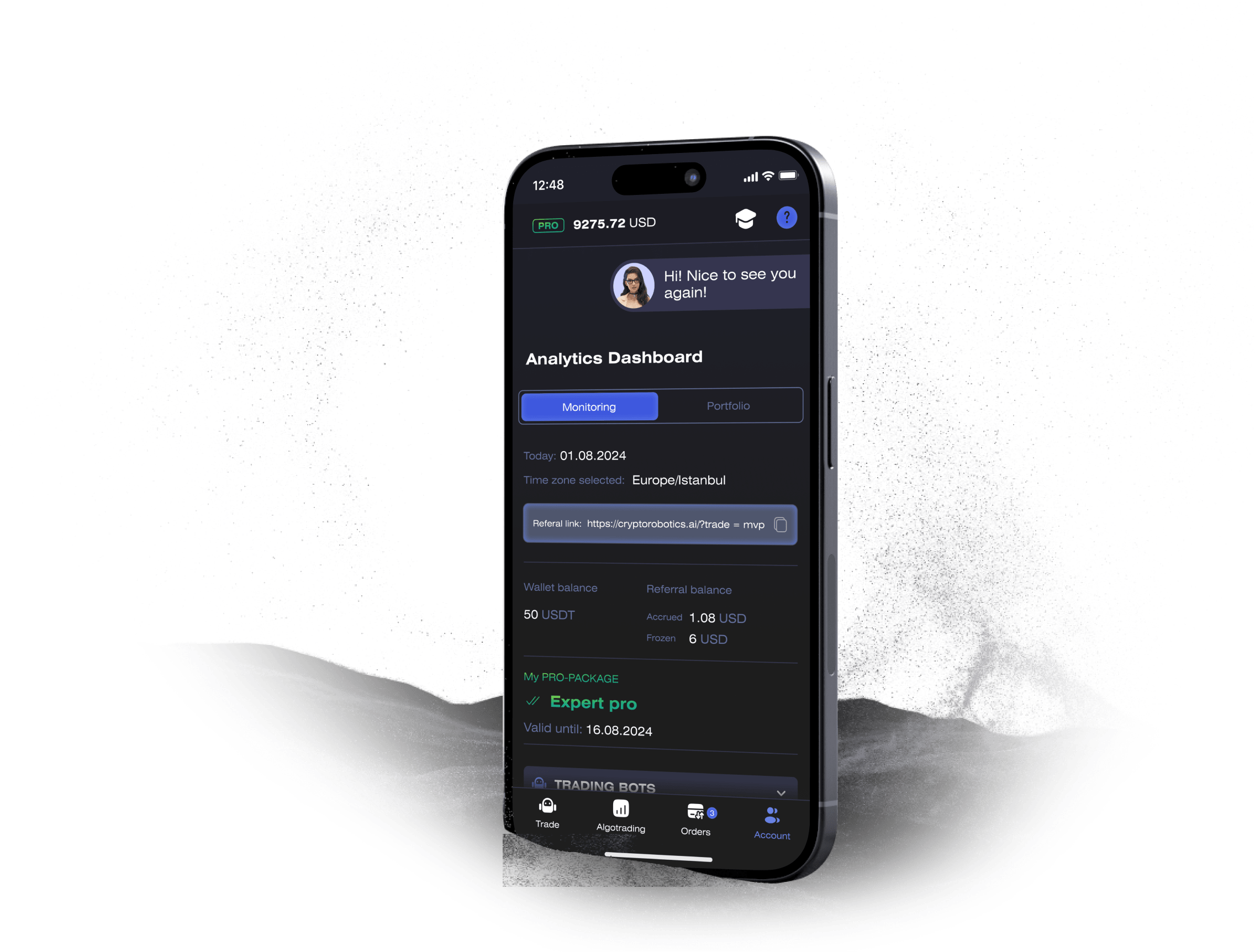

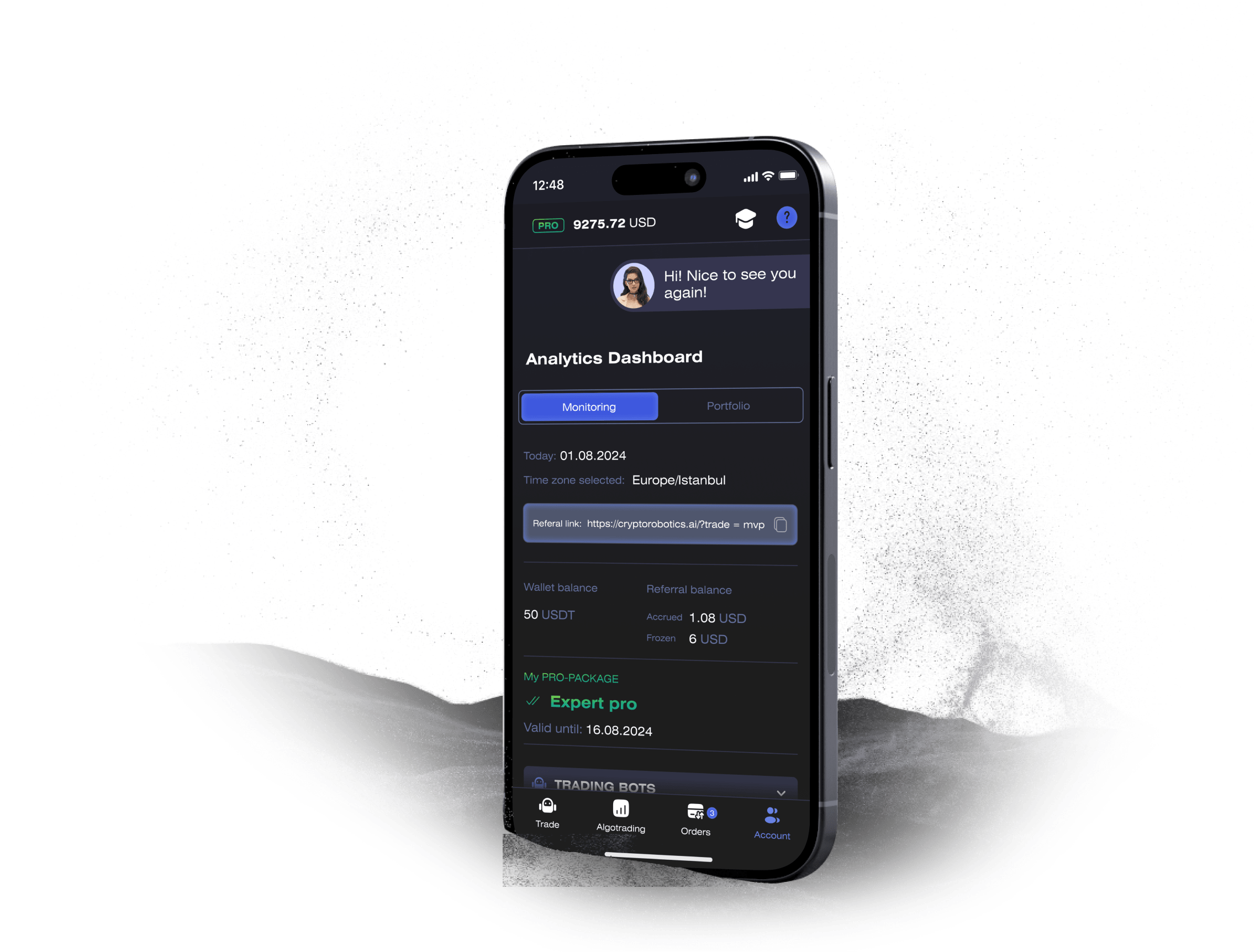

Access the full functionality of CryptoRobotics by downloading the trading app. This app allows you to manage and adjust your best directly from your smartphone or tablet.

News

See more

Blog

See more