Published: October 28, 2025 at 8:00 am

Updated on October 28, 2025 at 8:00 am

In the vibrant landscape of decentralized finance (DeFi), the promise of an open and user-centric financial ecosystem has garnered the attention of investors around the globe. However, the chaotic journey of the HYPE token on the Lighter exchange serves as a critical wake-up call, revealing the hidden perils of this digital terrain. Triggered by a faulty automated trading bot, this incident not only highlights the fragility of automated trading mechanisms but also raises serious questions regarding the core values of transparency and market integrity that are fundamental to DeFi.

DeFi has long been celebrated for its dedication to clear, tamper-proof transactional data. Yet, the extraordinary volatility of the HYPE token—soaring from $48 to an astonishing $98 before plummeting back—unveils the susceptibility of decentralized exchanges to the whims of technological automation. Central to this dilemma is the infamous “runaway bot,” illustrating that while these technological tools are designed to empower the crypto space, they can equally breed instability and market distortion.

The choice made by Lighter to erase the brief price anomaly from its platform has ignited a firestorm of debate within the crypto community. Critics argue this censorship undermines the fundamental principles of data transparency and market fairness, masking systemic weaknesses such as liquidity depth and platform resilience. In contrast, supporters advocate for a thoughtful user interface that protects traders from erratic market conditions, arguing that it’s possible to achieve equilibrium without sacrificing the essential truths provided by blockchain technology.

At the heart of DeFi’s charm lies an assurance of democratized finance facilitated by tools like bot trading on KuCoin. Nevertheless, the HYPE token saga clearly illustrates that these automated systems can act more as sources of upheaval than of stability. The conundrum is pronounced: how can DeFi platforms leverage the benefits of automation while preserving the integrity and transparency of on-chain trades? This ongoing challenge necessitates a nuanced reevaluation of strategies to curtail the risks associated with automated trading, ensuring these systems fulfill their roles without jeopardizing market health.

The discord stemming from the HYPE incident transcends mere technical difficulties, delving into profound philosophical and governance implications for decentralized platforms. How should DeFi projects balance the advantages of automation against the potential for disarray? The complexity deepens with revelations concerning centralized control issues on platforms like Hyperliquid, exposing a tension between the idealistic vision of decentralization and the pragmatic requirements for governance and oversight.

For traders sailing the tumultuous seas of the cryptocurrency market, episodes like the HYPE token spike emerge as vital lessons. They elucidate the necessity for vigilance and analytical skills in discerning genuine market shifts from those influenced by technical flaws that arise from platform governance. A keen understanding of market mechanics and liquidity dynamics equips traders with the insights essential to navigate the choppy waters of digital finance.

The saga of the HYPE token, driven by an errant automated trading bot, casts a revealing light on the delicate and intricate nature of the DeFi ecosystem. As decentralized finance navigates its future, the insights drawn from such events are paramount in striving for a more robust and transparent system. For traders, such incidents are stark reminders that discernment is crucial; they must recognize the interconnectedness of automated systems, platform choices, and market behavior. Ultimately, it will be the collective wisdom and governance frameworks cultivated by the crypto community that guide this vessel through turbulent waters, safeguarding the integrity of decentralized markets amidst persistent innovation and expansion.

Related Topics

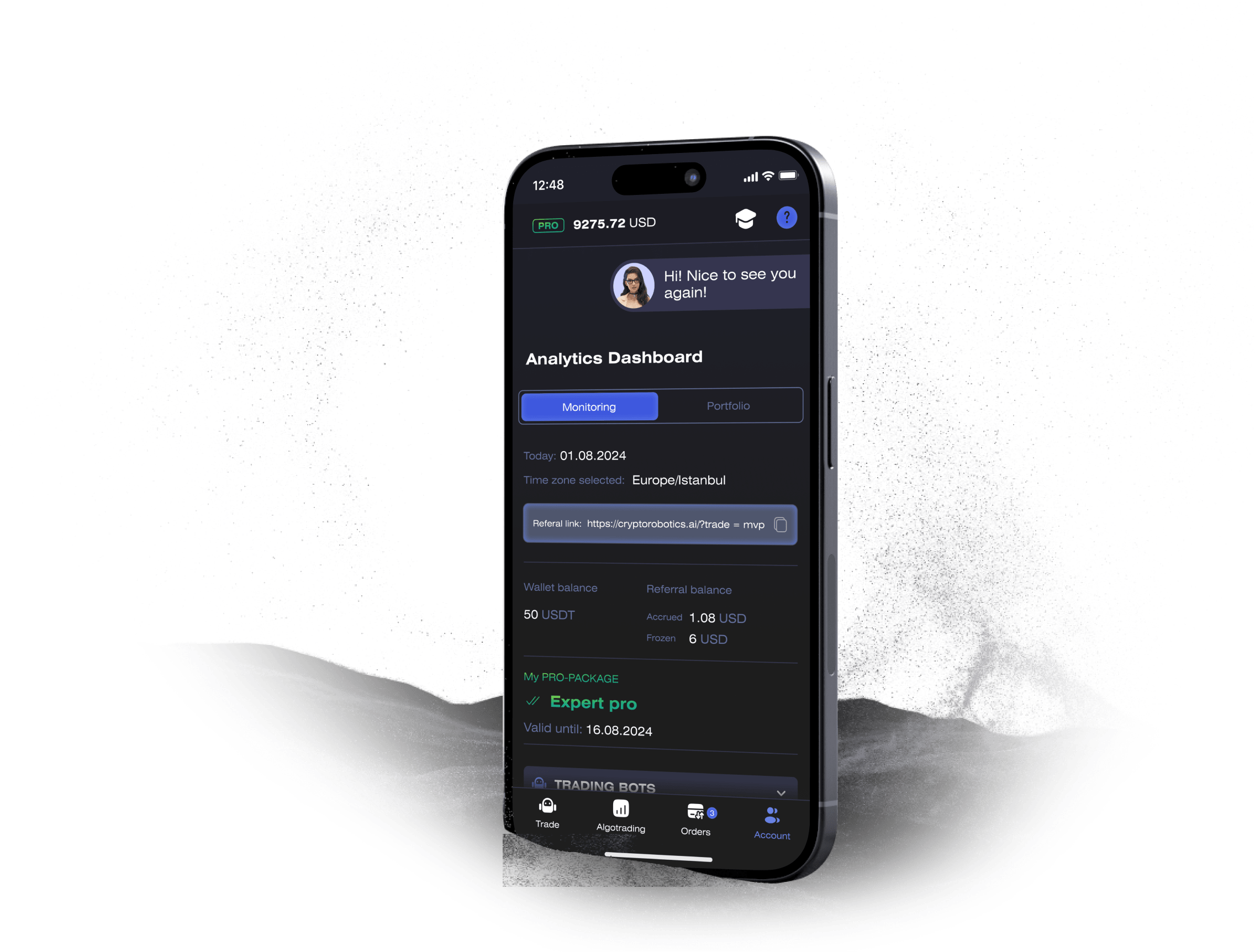

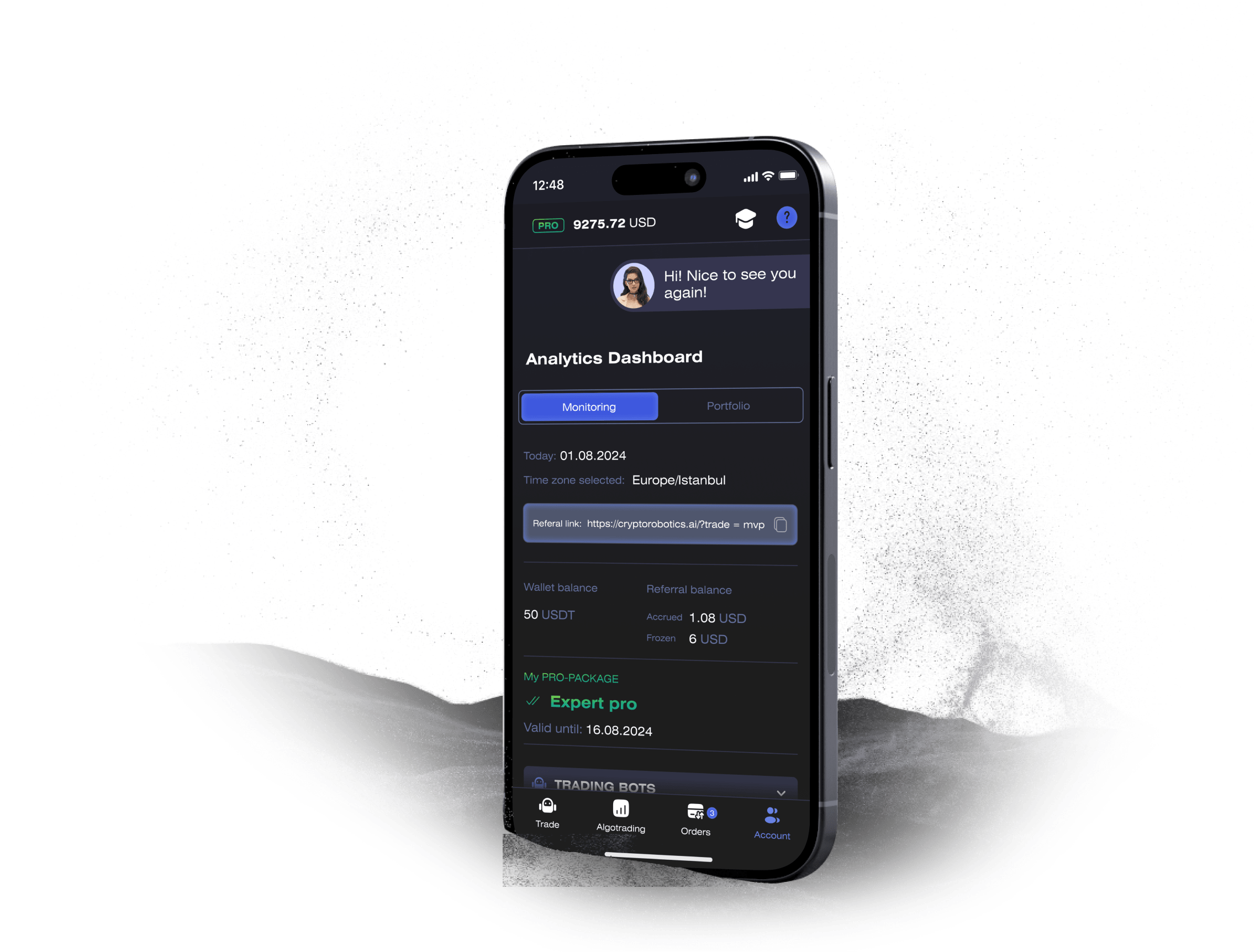

Access the full functionality of CryptoRobotics by downloading the trading app. This app allows you to manage and adjust your best directly from your smartphone or tablet.

News

See more

Blog

See more