Published: January 27, 2026 at 8:31 pm

Updated on January 27, 2026 at 8:41 pm

Impermanent loss is one of the most critical—and most misunderstood—concepts in decentralized finance. For many liquidity providers (LPs), it is the hidden variable that determines whether providing liquidity is profitable or quietly destructive to capital. While high APYs and incentive programs often dominate attention, impermanent loss is the structural cost that underpins automated market maker (AMM) design.

Understanding impermanent loss is not optional for anyone allocating capital to liquidity pools. It is a fundamental economic mechanism, not a temporary market anomaly or a protocol flaw. This article provides a comprehensive, professional explanation of impermanent loss, why it exists, how it behaves under different market conditions, and how liquidity providers should evaluate it in practice.

Impermanent loss refers to the difference in value between:

This difference arises when the relative prices of the pooled assets change.

If prices remain constant, impermanent loss does not occur. The moment prices diverge, impermanent loss begins to accumulate.

The term impermanent reflects the fact that the loss is theoretical until liquidity is withdrawn. However, once liquidity is removed from the pool, the loss becomes permanent.

Impermanent loss is not a bug or inefficiency. It is the direct consequence of how AMMs function.

AMMs replace order books with mathematical formulas that continuously rebalance asset ratios inside a pool. When prices move, the AMM forces liquidity providers to:

This automatic rebalancing smooths price movements for traders but transfers volatility risk to liquidity providers.

In simple terms, LPs are paid fees to absorb price volatility. Impermanent loss is the cost of providing that service.

Consider a liquidity pool with two assets of equal value.

Total position: $2,000

If Asset A doubles in price while Asset B remains unchanged, an AMM does not let you simply keep the same quantities. Instead, the pool rebalances:

When you withdraw, the total value of your position is lower than if you had simply held both assets outside the pool.

That difference is impermanent loss.

A common misconception is that impermanent loss is hypothetical or irrelevant until withdrawal. In reality:

If prices later return to their original ratio, impermanent loss can disappear. If they do not, the loss remains embedded in the position.

Liquidity providers should treat impermanent loss as a real economic exposure, not an accounting curiosity.

Impermanent loss increases as price divergence increases. The relationship is non-linear.

Key characteristics:

Importantly, impermanent loss is symmetric. Large upward or downward price movements have similar effects.

The AMM does not care about direction—only divergence.

Trading fees are the economic counterweight to impermanent loss.

Liquidity providers earn fees because they are:

For liquidity provision to be profitable, fee revenue must exceed impermanent loss.

High APY figures are meaningless if they do not compensate for volatility-driven losses.

Impermanent loss becomes particularly significant under certain conditions.

Pairs involving volatile assets experience larger price swings, increasing divergence risk. This is why pools with two volatile tokens are structurally riskier than stable pairs.

The longer capital remains exposed, the greater the probability of large price divergence.

Impermanent loss compounds with time, especially in trending markets.

Low-liquidity pools experience sharper price movements per trade. This increases slippage and magnifies impermanent loss for LPs.

Stablecoin-to-stablecoin pools are often cited as low-risk liquidity strategies.

This is because:

However, reduced impermanent loss comes with lower fee potential and exposure to other risks, such as depegging events.

Lower risk does not mean zero risk.

One of the most counterintuitive aspects of impermanent loss is its behavior in strong trends.

If an asset trends upward aggressively, liquidity providers underperform holders of that asset. This happens because LPs are continuously selling into the rally.

In bull markets, liquidity provision on volatile pairs often underperforms simple holding—even when APYs look attractive.

This is why many professional LPs prefer range-bound or mean-reverting assets.

A critical misunderstanding is the belief that impermanent loss only matters when prices fall.

In reality:

LPs profit most when markets are active but not directional.

Newer AMM designs allow liquidity providers to concentrate capital within specific price ranges.

This improves capital efficiency and fee generation, but it also changes impermanent loss dynamics.

Key trade-offs:

Concentrated liquidity does not eliminate impermanent loss. It redistributes risk.

Impermanent loss should always be evaluated relative to opportunity cost.

The correct comparison is not:

But rather:

In many cases, LPs are profitable in absolute terms but still underperform a passive holding strategy.

Professional analysis focuses on relative performance, not just nominal returns.

Liquidity mining programs often mask impermanent loss by inflating nominal returns.

Incentive tokens can temporarily offset losses, but they introduce additional risks:

Once incentives decline, impermanent loss becomes fully visible.

Liquidity provision that only works while subsidized is structurally fragile.

Impermanent loss does not disappear in bear markets; it often becomes harder to offset.

Several misconceptions repeatedly mislead liquidity providers:

Each of these assumptions has caused substantial capital erosion for LPs.

Experienced liquidity providers approach impermanent loss strategically.

Common practices include:

Liquidity provision is closer to market making than passive investing.

Before allocating capital, LPs should evaluate:

Impermanent loss is predictable in structure, even if prices are not.

At a systemic level, impermanent loss is how DeFi provides liquidity.

Traders receive instant execution and continuous liquidity. Liquidity providers receive fees and incentives—but accept volatility risk in return.

There is no free yield. Impermanent loss is the mechanism that enforces this reality.

Liquidity provision is most effective when:

Outside these conditions, impermanent loss often dominates outcomes.

Impermanent loss is not an edge case or a technical detail. It is the core economic trade-off of automated market makers. Any liquidity provider who does not understand impermanent loss is operating without a risk model.

AMMs work precisely because impermanent loss exists. It is how risk is transferred, priced, and compensated. Fees are not rewards for participation; they are payments for absorbing volatility.

For liquidity providers, the key question is never “What is the APY?” but rather:

“Is the fee income sufficient to justify the volatility risk I am absorbing?”

In decentralized markets, liquidity is not free, and impermanent loss is its cost. Understanding that cost is the difference between disciplined capital allocation and slow, silent erosion.

Related Topics

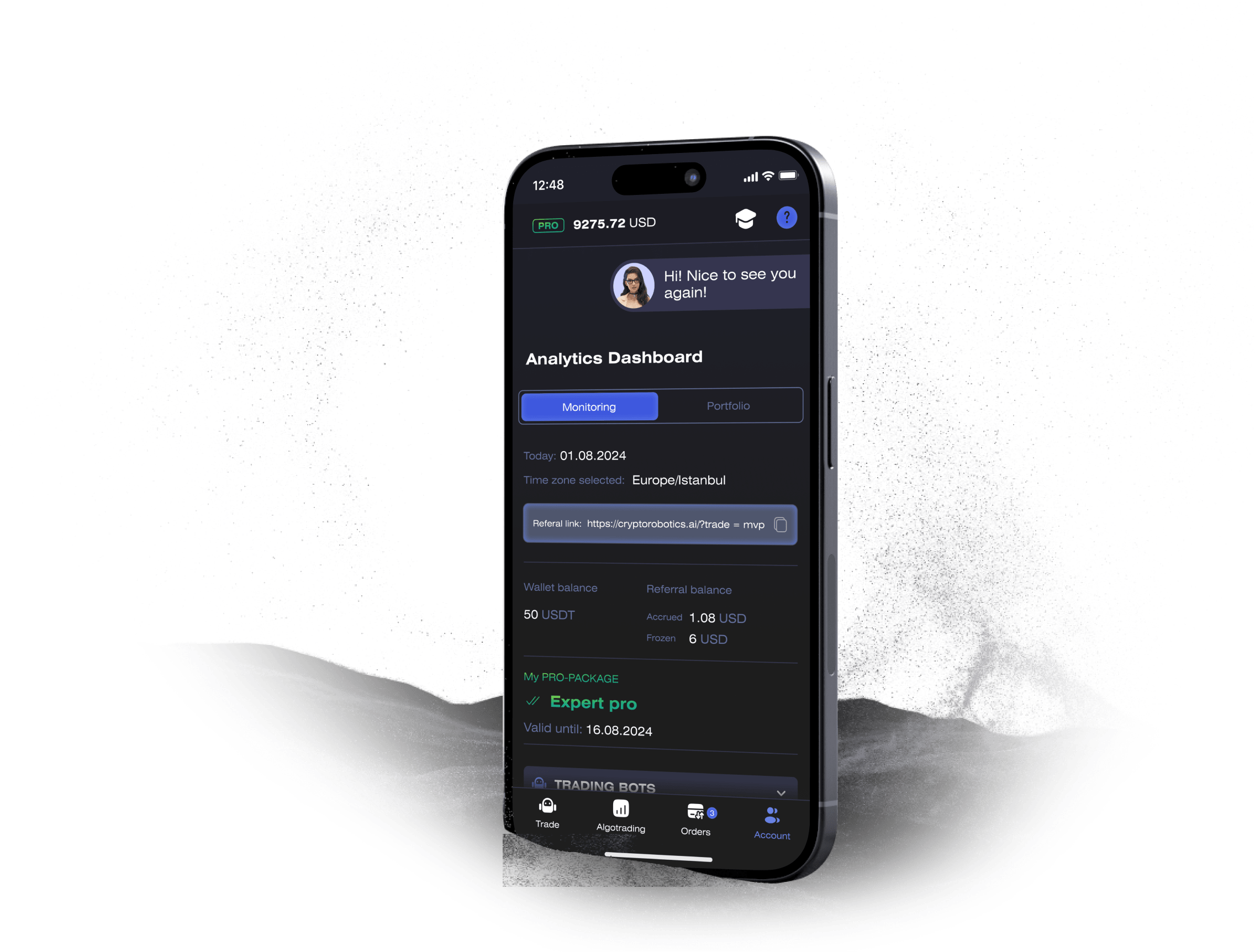

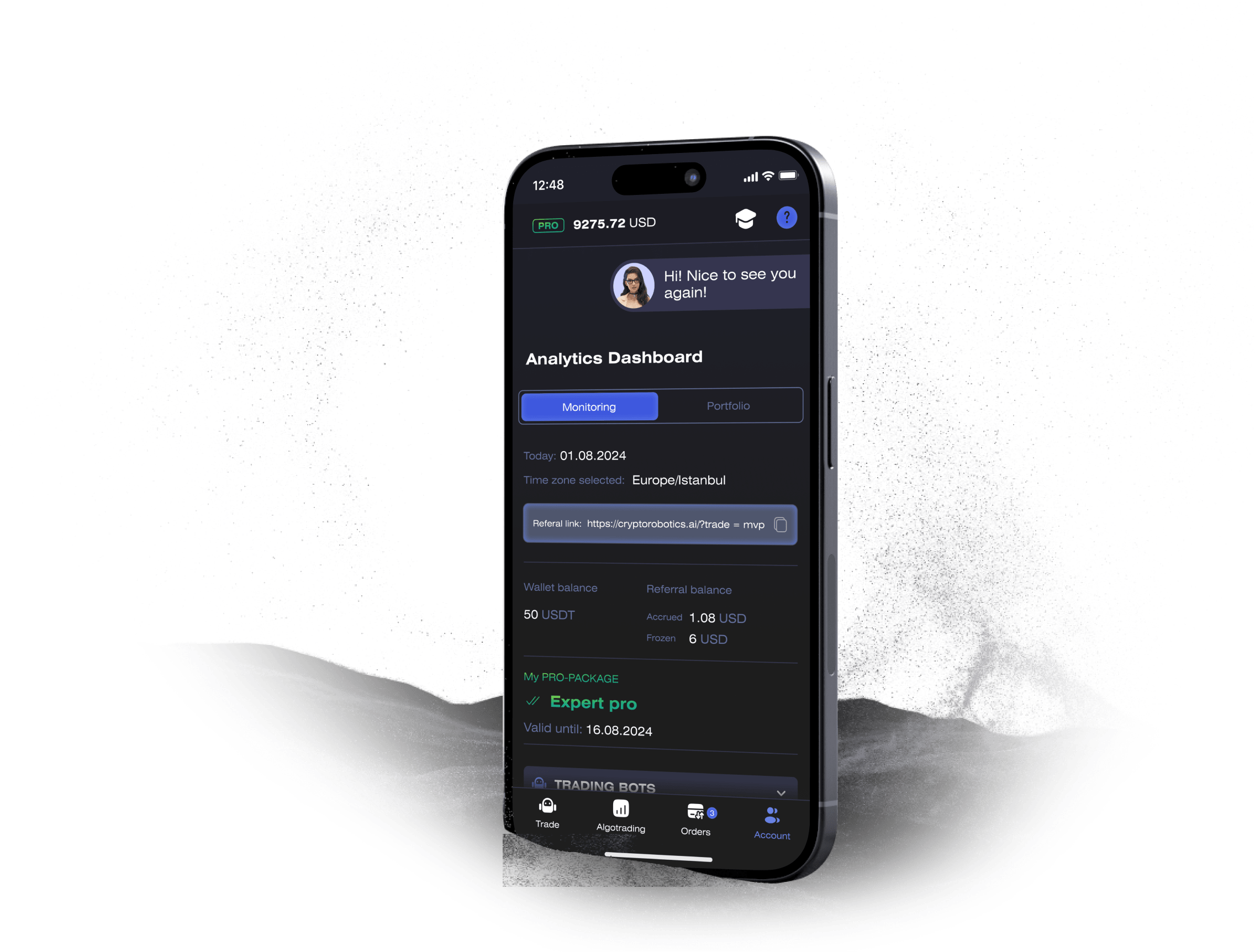

Access the full functionality of CryptoRobotics by downloading the trading app. This app allows you to manage and adjust your best directly from your smartphone or tablet.

News

See more

Blog

See more